salt tax cap news

Many states have been following the trend of passing PTE pass-through entity election laws in the wake of the enacted SALT cap for individual itemized deductions. In determining the SALT cap for their tax returns.

Salt Deduction Relief May Be In Peril As Build Back Better Stalls

Starting with the 2018 tax year the maximum SALT deduction available was 10000.

. Democrats say the measure was intended to target. Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for 2018. Most people do not qualify to itemize The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or local.

House of Representatives passed a partial repeal of the SALT cap by a vote of 218206 with. The taxpayer did not receive a tax benefit on the taxpayers 2018 federal income tax return from the taxpayers overpayment of state income tax in 2018. News VP Harris Breaks Tie Senate Passes Democrats Inflation Reduction Act Climate Tax and Spending Bill.

The benefit of a PTE election is that the entity pays the state income taxes due rather than the individual partners or shareholders who would then. Democrats from high-tax blue states are insisting on the repeal of a rule that limits state and local tax SALT deductions to 10000 which was enacted as part of the 2017 tax law signed by. They would have less tax to pay at the federal level and in effect get the benefit of those taxes as a tax deduction and not have this tax deduction limited at the personal level The tax provisions can vary from state to state however.

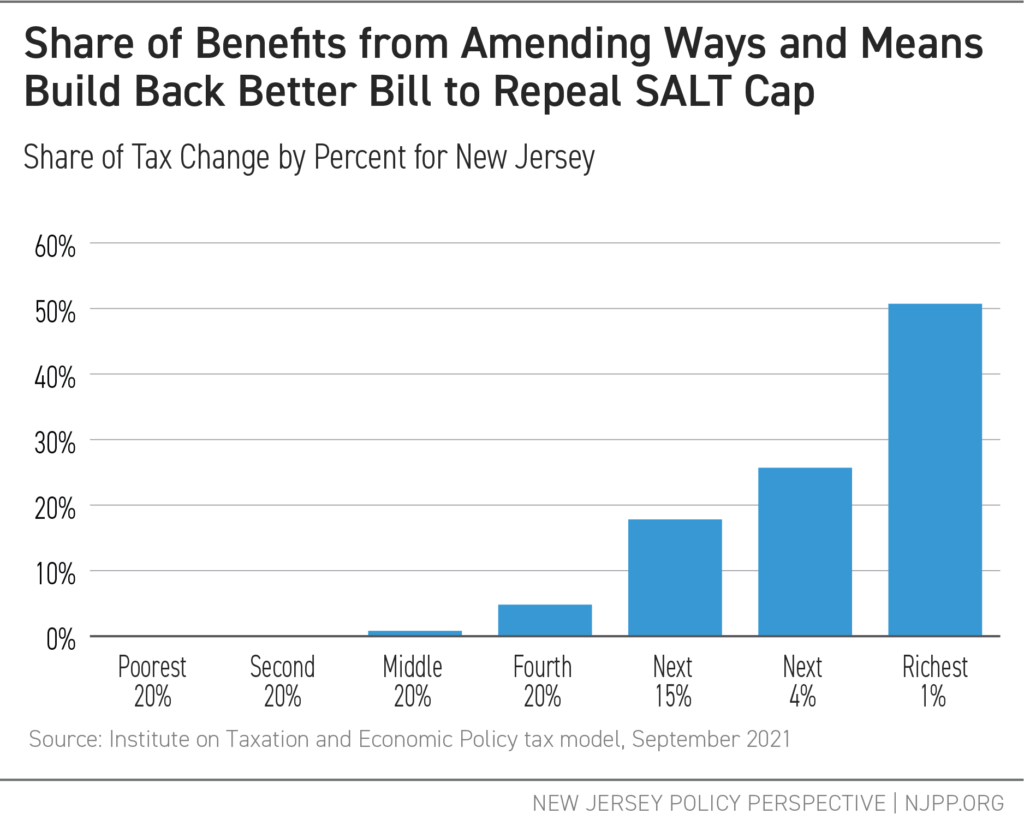

Is a 501c3 public charity and contributions are tax deductible In case you missed it Utah youths hold die-in for Great Salt Lake challenge elected leaders to. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the Urban-Brookings Tax. Such adjustments will take place at the end of each tax year until the corporate income tax rate is reduced to a cap of 55.

In addition the states individual top tax rate will be reduced annually from 2023 through 2026 ultimately resulting in a 39 flat tax being imposed in 2026. The maximum SALT deduction is 10000 but there was no cap before 2018 You must itemize using Schedule A to claim the SALT deduction. Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent Inflation Reduction Act.

House Democrats concede line in sand over ending SALT cap The fight over the 10000 cap on state and local tax deductions has been pronounced in Northeastern states and California where. A handful of House Democrats from high-tax states New Jersey and New York are still demanding that relief from a 10000 cap on deductions for state and local taxes be included if they are. The SALT cap did become part of the final negotiations over the weekend specifically how to use the revenue from it.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. The 10000 SALT cap was imposed starting in 2018 as a way to pay for some of the levy cuts in former President Donald Trumps tax cut law. Senator Mark Warner D-VA replaced the SALT cap extension with an amendment to extend.

House Democrats on Friday passed their 175 trillion spending package with a temporary increase for the limit on the federal deduction for state and local taxes known as SALT. It would reduce their federal K-1 income by that 100000. Bonnie Baxter director of the Great Salt Lake Institute and Dr.

The Senate is still voting on a lengthy series of amendments to the Democrats 437 billion climate health and tax package leading up to expected passage of the legislation as soon as Sunday. The bill would. The cap applies to upper.

Robert Gillies director of the Utah Climate Center join the show to discuss what is happening to the GSL why it matters. Republicans sought to use the revenue to exempt businesses owned by private equity from the new corporate minimum tax but some Democrats balked and passed a separate amendment to pay for the change by extending limits on. Tom Suozzis defense of uncapping the 10000 state-and-local-tax deduction is all wrong Letters Aug.

News Company News Markets News. A stir because it would cause electoral problems for House Democrats in coastal districts who campaigned on ending the SALT cap. In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the raised cap set to expire January 1 2032.

Most provisions of the Trump tax cuts expire in three years so Democrats best route may simply be to let the SALT cap disappear at that point said Steve Wamhoff director of federal tax policy. The Salt Lake Tribune Inc. The Workaround for the State and Local Tax SALT Cap.

A deal later announced between Manchin and Senate Majority Leader Chuck Schumer on a fiscal package that spans tax climate and health care measures also omitted any SALT-cap expansion. Its not an issue of red states versus blue states. Not every state has done it said Ross.

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

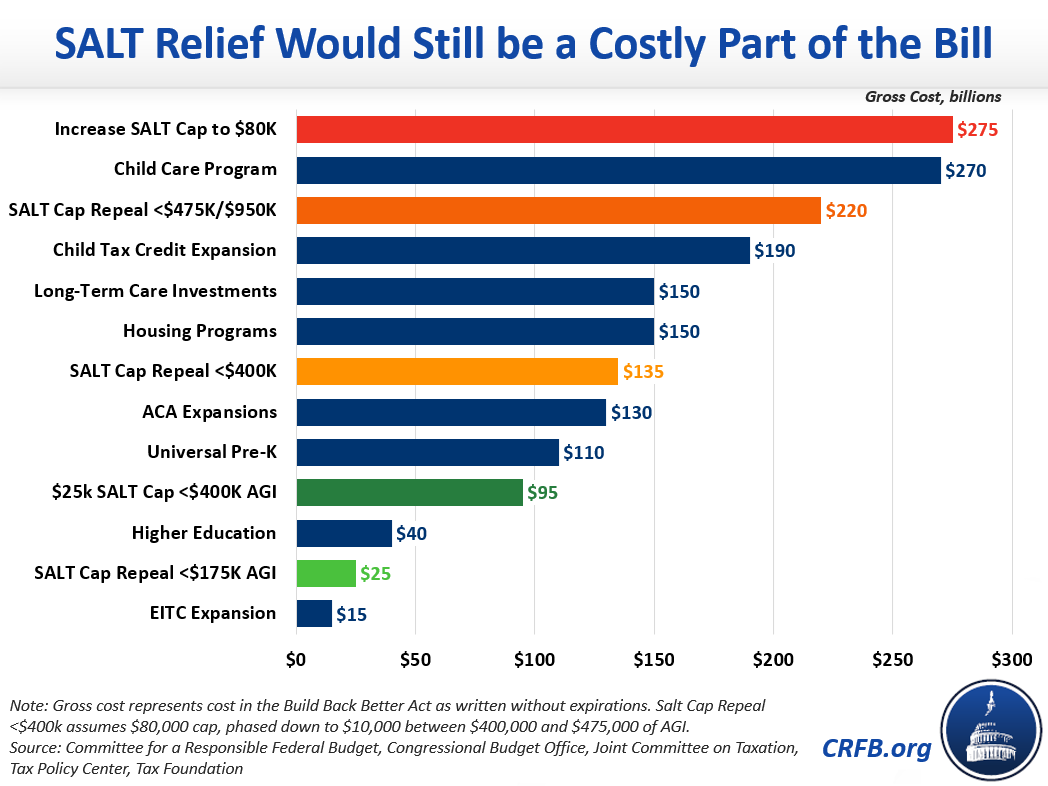

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

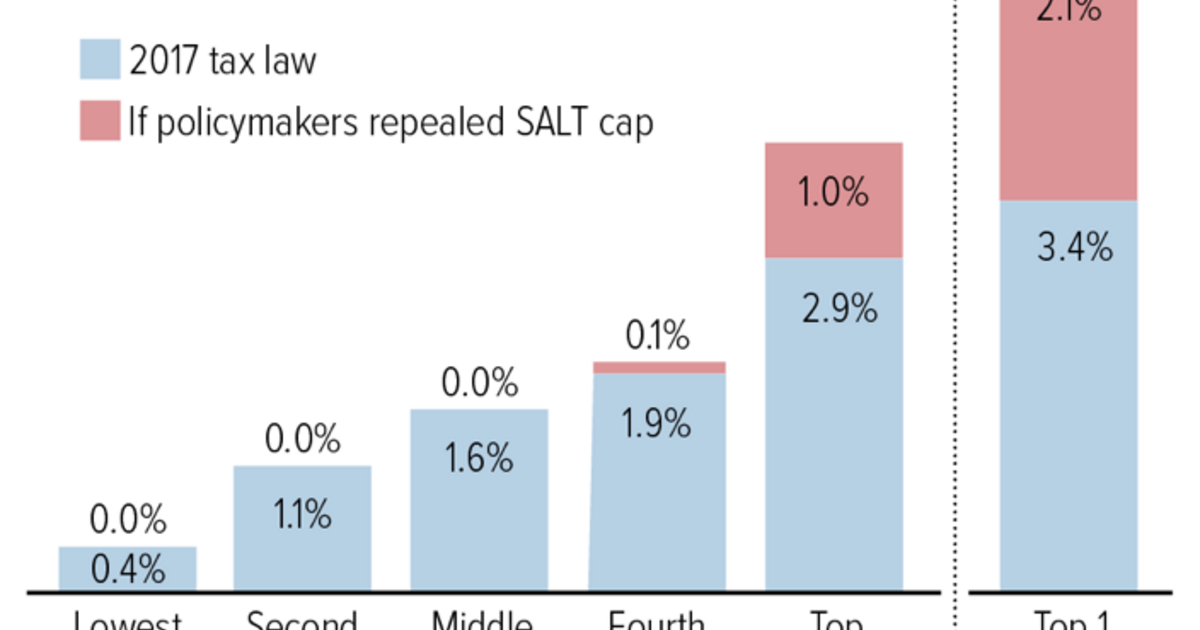

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Local Business Alert We Are Lucky To Live In A Place Where Local Businesses Are So Colorful And Significant We D Like To Local Charity Tax Help Wardrobe Rack

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget