where's my unemployment tax refund irs

The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. Using the IRSs Wheres My Refund feature.

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records.

:max_bytes(150000):strip_icc()/Balance_Tax_Refund_Status_Online_1290006-9f809670a73041a7a6caa96dd5592c99.jpg)

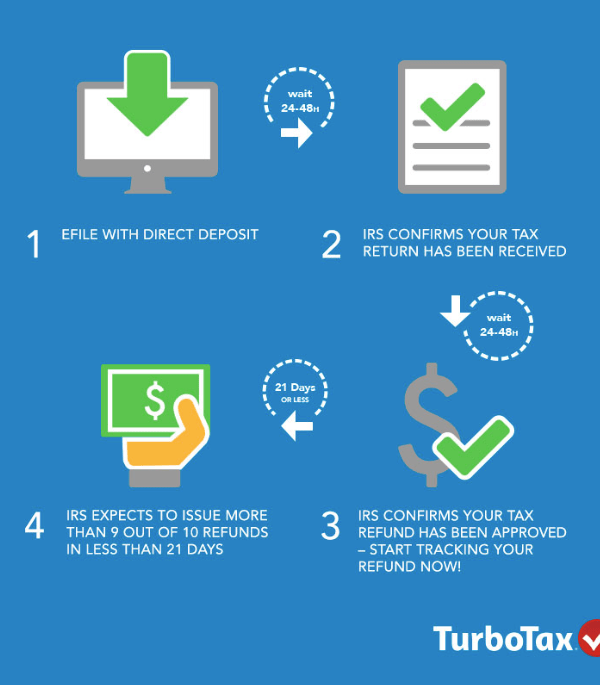

. Its best to locate your tax transcript or try to track your refund using the Wheres My Refund tool. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. Bob Dyer and likely millions of other taxpayers are still waiting for tax year 2020. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of.

Is the IRS still processing 2020 unemployment tax refund. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. The Internal Revenue Service doesnt have a separate portal for checking.

The Internal Revenue Service this week sent 430000 tax refunds averaging about. The first way to get clues about your refund is to try the IRS online tracker applications. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records.

November 23 2022 1212 PM 6 min read. The unemployment tax refund is only for those filing individually. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by.

Because we made changes to your 2020 tax account to exclude unemployment compensation you may be eligible for the Additional Child Tax Credit. Bob Dyer and likely millions of other taxpayers are still waiting for tax year 2020 refunds from the IRS. For many the wait continues.

The legislation excludes only 2020 unemployment benefits from taxes. Can you track your unemployment tax refund. The IRS previously issued refunds related to unemployment compensation exclusion in May and June and it will continue to issue refunds throughout the summer.

You wont be able to track. How To Use Tax Refund Trackers And Access Your Tax Transcript. The average IRS refund for those who paid too much tax on jobless benefits is 1686.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. Because the change occurred after some people filed their taxes the IRS will take steps in the spring. You can still claim the special exclusion for unemployment compensation received in tax year 2020 if you havent filed your 2020 tax return and your AGI is less than 150000.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. This is the fourth round of refunds related to the unemployment compensation. Earlier this summer I wrote.

How much is the IRS Unemployment Tax Refund. IRS to send refunds for taxes paid on unemployment benefits. How do I check my status for.

Viewing the details of your IRS account. Taxpayers should not have. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Stimulus Check Update When Will Plus Up Covid Payments Arrive

What To Know About Irs Unemployment Refunds

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

3 11 154 Unemployment Tax Returns Internal Revenue Service

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Tax Refund Timeline Here S When To Expect Yours

Irsnews On Twitter Use The Where S My Refund Tool To Start Checking The Status Of Your Refund 24 Hrs After Irs Acknowledges Receipt Of Your E Filed Tax Return You Can Access The

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Where S My Tax Refund The Turbotax Blog

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

Report Unemployment Benefits Or Income On Your Tax Return

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back